Credit Risk Management ist der Schlüssel zu sicherem, nachhaltigen und profitablen Wachstum in Finanzinstituten. Aufgabe des Credit Risk Managements ist die Bewertung und Steuerung von Kreditrisiken und die Gewährleistung der Profitabilität der Engagements.

Die Kreditentscheidung wird auf Basis der vorliegenden Informationen und entsprechend der individuellen Kreditpolitik des Finanzinstituts, unter Einhaltung einer Vielzahl regulatorischer Anforderungen, insbesonderer solcher aus dem Kreditwesengesetz (KWG), getroffen.

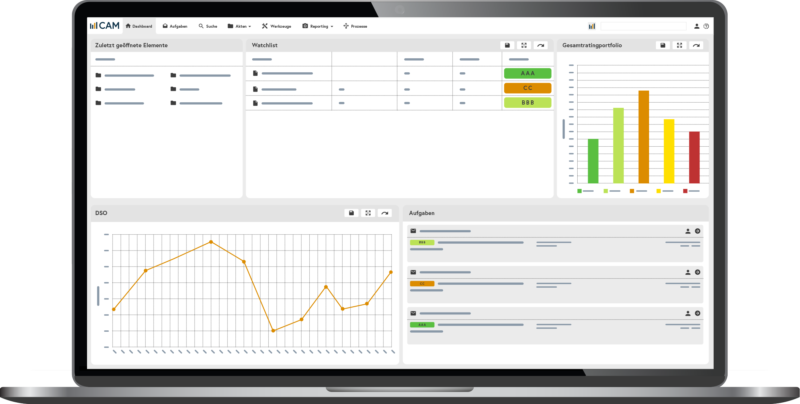

CAM Financial Services übernimmt alle Funktionen, von der Kreditwürdigkeitsprüfung bis zur Festlegung von Kreditlimiten und der Überwachung von Engagements.