On the one hand, banks and financial service providers are obliged from a regulatory perspective to carry out effective credit risk management. CAM Financial Services is contributing to this.

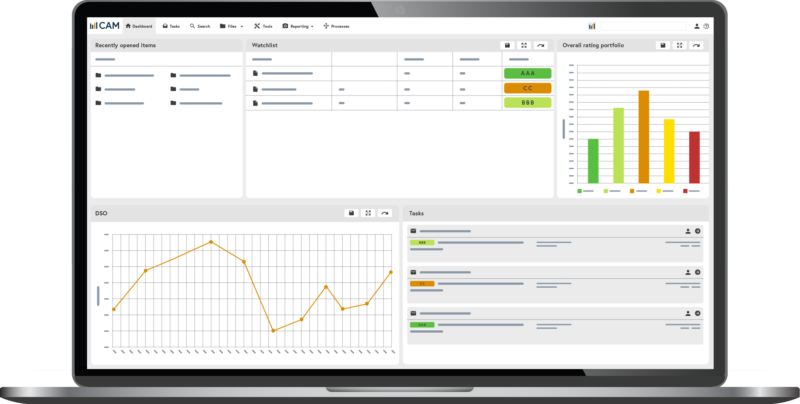

Above all, however, our Credit Risk Management Software offers relief in daily business with automatic decision-making processes. It thus supports banks and financial service providers in the complex tasks and decisions in the area of credit risk management through workflow-based credit application processes and, if desired, integrated KYC processes.

Decisions can be made faster, more efficiently and more objectively. Employees are relieved of routine tasks. Thus, CAM Financial Services allows you to access new markets and enables faster revenue growth.