As a leasing company, you face the challenge of meeting the increasing expectations of your customers. They want immediate decisions, at any time, and on terms they have long known from their private lives: fast, convenient, digital.

In contrast, of course, in an uncertain market environment you need more than ever to assess risks correctly and react appropriately. These reactions sometimes have to be quick and you can't wait until a software developer has time for you. You should be able to do that yourself!

And then there is the " tiresome" topic of compliance - here, too, the requirements are becoming more and more extensive. Here, too, it is important to find a solution that - as far as possible - automatically ensures all the necessary measures. And of course documented, so that there are no unpleasant surprises during audits.

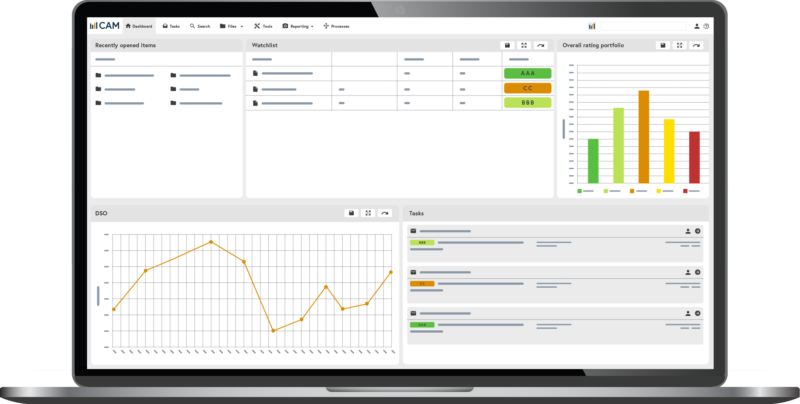

With our credit risk management software CAM Financial Services, we offer you a fully integrable solution for your auditing and decision-making processes that paves the way to growth and success.