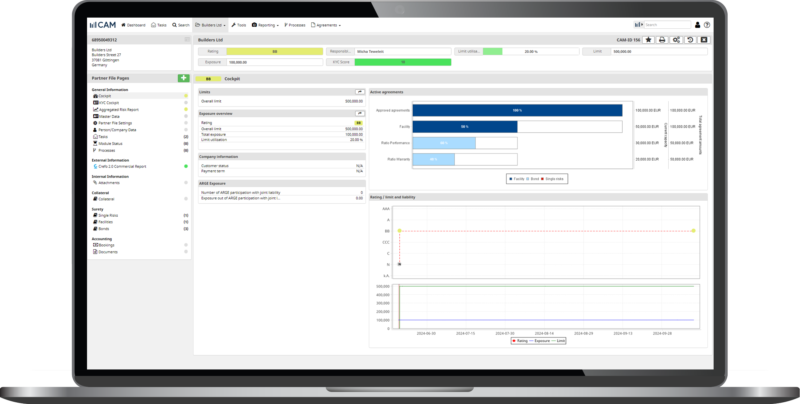

CAM Surety is the software solution for surety insurers that offers portfolio management, risk assessment and product management in one system and under one interface.

It supports you in the

digitisation of your business - from the access of customers and brokers

via a portal to the connection to business partners such as information

providers.