Risk managers face the daily challenge of minimizing risk in the processing of transactions. After all, bad debt losses can only be minimized if the risk of default is analyzed regularly and identified at an early stage.

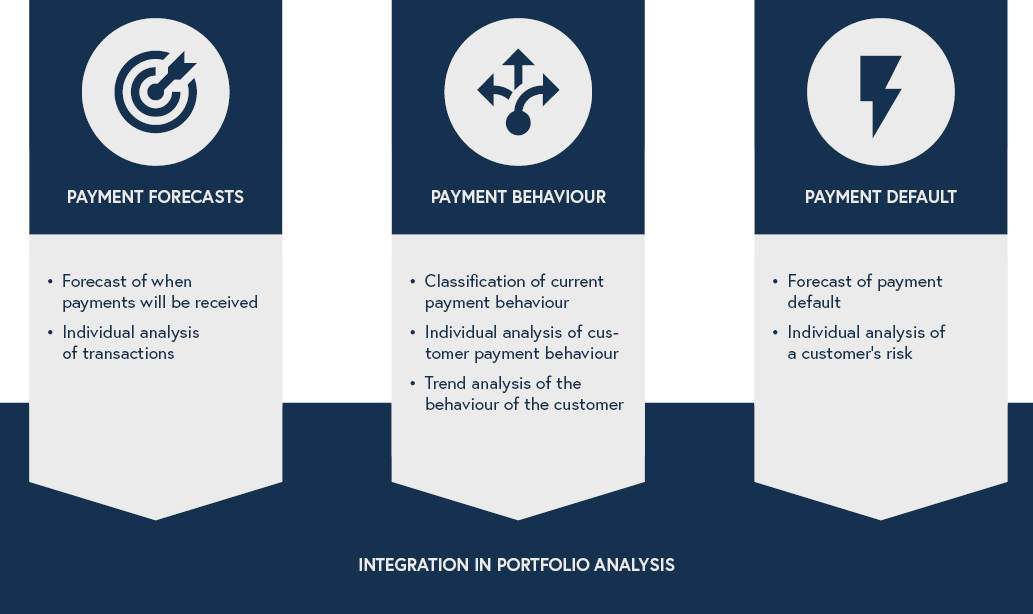

With the help of ALEVA Payment Experiences, your internal payment experiences are analyzed and evaluated by our models. The analyzes can be used to determine default probabilities and create risk forecasts that can be used as a basis for decision-making.

Our intelligent and dynamic evaluation of internal payment experiences allows you to improve and relieve your credit risk management.