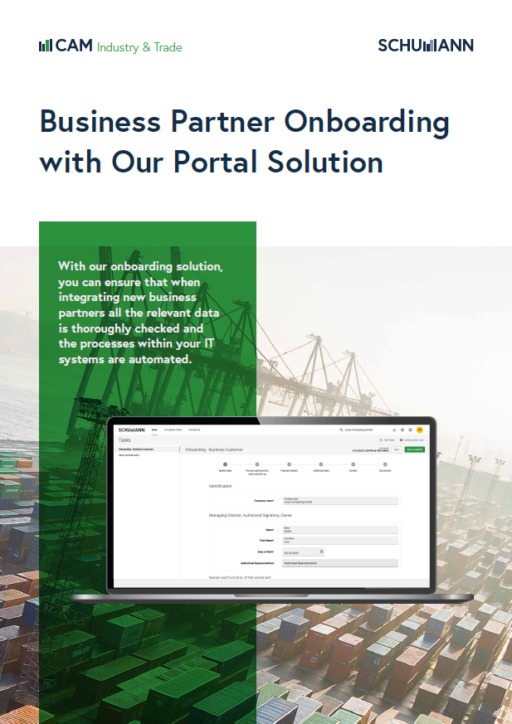

With CAM Industry & Trade you create transparency of your credit risks and manage them efficiently and reliably.

With our credit management software you can automate all the relevant processes that you need to achieve your profit and liquidity targets. This includes all the procedures from the creditworthiness check via the interaction with commercial credit insurers to dunning and debt collection.