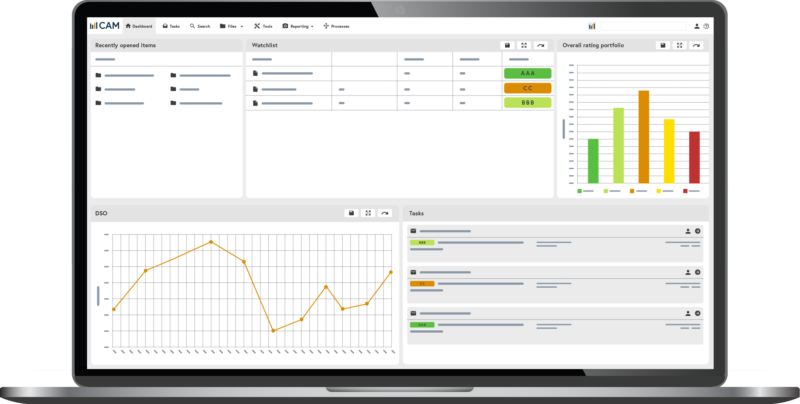

Our software allows you to automate your decision and limit management processes while retaining full control of your business. In addition to the ability to make decisions fully automatically or with any level of manual intervention, you can quickly and easily customise processes, decision rules and other aspects to suit your own needs. The result is fast, secure and documented decisions and the ability to scale your business.

Get the competitive edge!