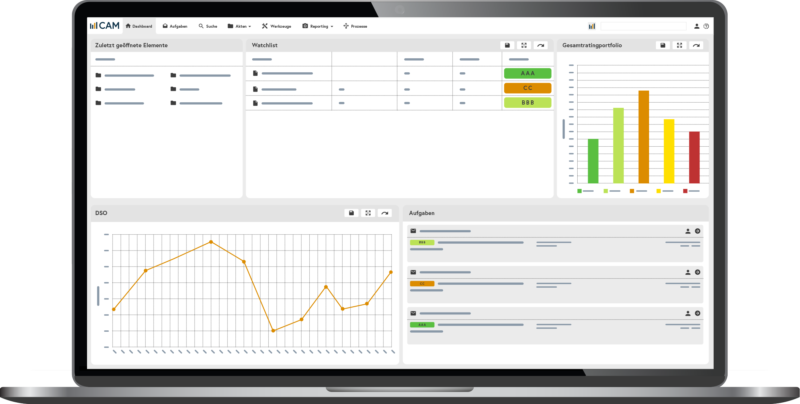

Mit unserer Lösung für Factoring

automatisieren Sie Ihre Prozesse ohne dabei die Kontrolle aus der Hand

zu geben.

Neben den vollautomatisierten bis zu manuellen Gremienentscheidungen, können Sie Prozesse, Regelwerke für Entscheidungen und Weiteres einfach und schnell selbstständig anpassen. Das Ergebnis sind schnelle, sichere und dokumentierte Entscheidungen, sowie die Möglichkeit Ihr Geschäft zu skalieren.

Sichern Sie sich den entscheidenden Wettbewerbsvorteil.