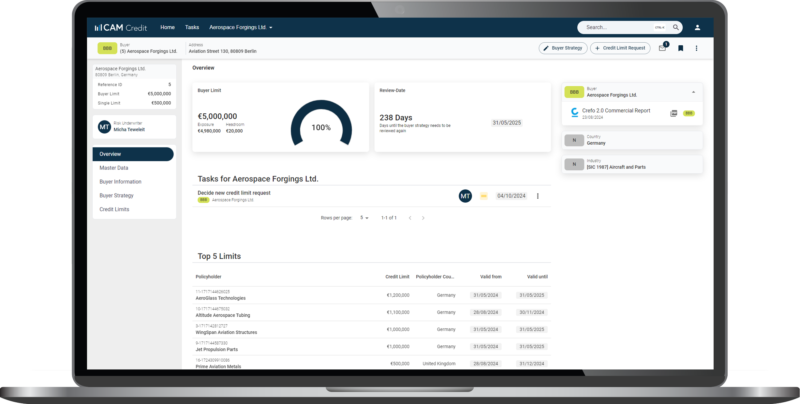

CAM Credit - The intelligent software solution for efficient underwriting processes! Our solution guides and supports underwriters in complex decisions and relieves them of the bulk of clear decisions through automation in order to focus on the more complex risks to be analysed.

CAM Credit not only provides you with smart support in your day-to-day business, but also the flexibility to customise the software to your individual requirements. Take advantage of the wide range of digitalisation and automation options and maintain an overview of your portfolio at all times without relinquishing control. With CAM Credit, you can digitally optimise your underwriting processes and drive your business growth at the same time.