Als Leasing-Gesellschaft stehen Sie vor der Herausforderung, den zunehmenden Erwartungen Ihrer Kunden gerecht zu werden. Sie wünschen umgehende Entscheidungen, zu jeder Zeit, und zu Bedingungen, die sie aus dem Privatleben schon lange kennen: schnell, bequem, digital.

Dem gegenüber müssen Sie in einem unsicheren Marktumfeld mehr denn je Risiken richtig einschätzen und entsprechend darauf reagieren. Diese Reaktionen müssen manchmal schnell erfolgen und Sie können nicht warten bis ein Software-Entwickler Zeit für Sie hat. Das sollten Sie selbst können!

All diese Tätigkeiten müssen entsprechend der Regulatorik ausgeführt werden. Auch hier gilt es eine Lösung zu finden die - so weit wie möglich - alle erforderlichen Maßnahmen automatisch sicherstellt. Und natürlich dokumentiert, damit es bei Prüfungen keine bösen Überraschungen gibt.

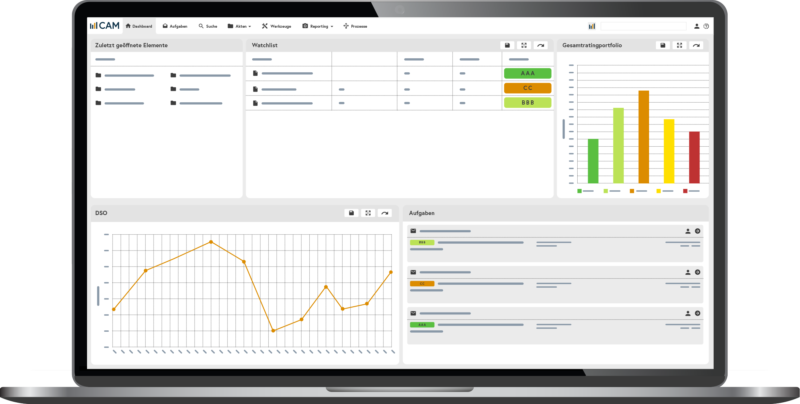

Wir bieten Ihnen mit unserer Credit Risk Management Software CAM Financial Services eine voll integrierbare Lösung für Ihre Prüfungs- und Entscheidungsprozesse, die Ihnen den sicheren Weg zu Wachstum und Erfolg ebnet.