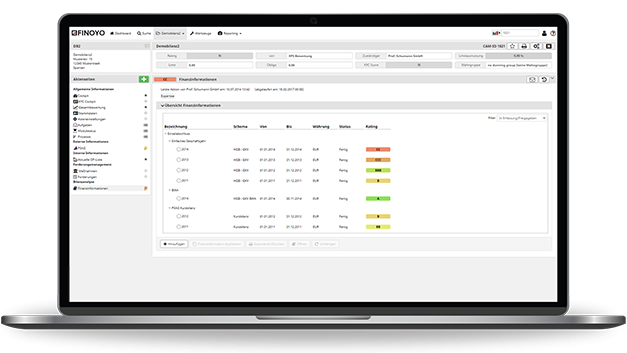

FINOYO ist die Cloud-basierte Bilanzanalyse-Software von SCHUMANN, mit der Sie die wirtschaftliche Stabilität Ihrer Geschäftspartner treffsicher bewerten können. Die Bilanz- und GuV-Analyse ist standardisiert und revisionssicher.

Mit FINOYO können Sie Finanzinformationen automatisiert importieren (z. B. aus dem Bundesanzeiger) oder manuell erfassen. Sie erhalten ein automatisch berechnetes Bilanzrating inkl. eines umfangreichen Kennzahlenkatalogs und einer automatisch generierten Kapitalflussrechnung.

Mit unserer Bilanzanalyse Software profitieren Sie von vollständigen automatischen Analysen und haben mit Reports alle Daten auf einen Blick.