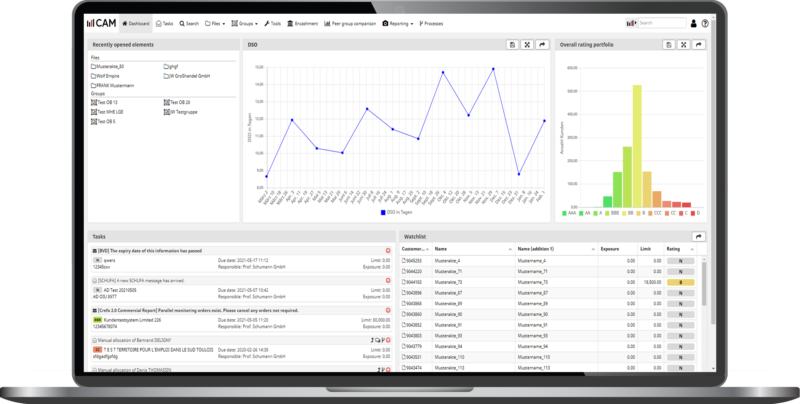

Standardised and audit-proof balance sheet analysis - with a wide range of options for importing data and direct evaluation in the form of key figures and graphs.

Risk Management Software for Your Industry

Credit & Surety Insurance

Financial Service Provider, Leasing & Factoring

Industrial, Wholesale & Energy Companies

Top Companies Worldwide Trust SCHUMANN

Our SaaS Solutions for Every Industry

KYBP Supply Chain Act Software

Design your own automated business partner process with KYBP. This speeds up onboarding, ensures due diligence and increases the quality of your business partner selection.

Our Various Applications

Compliance & KYC

Find out with whom you are starting to do business and guarantee compliance with your due diligence obligations through a multi-stage and transparent KYC process. With CAM, you achieve seamless auditing and monitoring of new and existing customers.

Compliance & Supply Chain Act

The Supply Chain Act (LkSG) obliges companies to identify, prevent, minimise or eliminate human rights and environmental risks. CAM supports you in complying with due diligence obligations.

Credit Limit Checking

Deciding on credit limits is a balancing act: Credit managers want to secure business and support the turnover targets of the company at the same time. CAM automates credit limit checking processes and facilitates decision-making.

Advantages of an Innovative Risk Management Software

Process Automation

Make room to focus on the important things.

Workflow Optimisation

Design your processes - and our software - by yourself.

Risk Mitigation

Always stay in control thanks to intelligent early warning systems.

Business Scaling

Achieve higher revenue with the same level of resources.

Know Your Customers

Meet complex compliance requirements within seconds.

Let's Grow Together

Your success is our success! Partnership is our top priority.

More on the Subject of Risk Management Software

Blog

Trade Credit Insurers: How to Overcome the Challenge of Manual Processes and Rising Costs

Automated data validation, rule-driven decisions, and real-time updates: Learn how CAM Credit transforms manual processes into faster, safer, and cost-efficient operations.

Success Stories

Credit Management goes from Complex to Simple

The steel trading company SPAETER has successfully introduced the software CAM Industry & Trade from SCHUMANN and achieved standardization, digitalization and automation of its credit management. A central solution has replaced the "home-made" systems of some of the companies in the SPAETER Group and thus unified and accelerated the processes.

Videos

Consequences of Global Dependencies on Products and Services for the German Economy

Germany's economy is heavily dependent on global supply chains – whether for energy, rare earths, chips, cloud services or medicines. The current crises show how risky unilateral dependencies can be and how urgently Germany needs its own production capacities in key technologies. Those who identify risks early on and diversify not only strengthen their competitiveness but also their strategic independence.

Online-Events

SCHUMANN CONNECT

The exclusive networking event for trade credit & surety insurers as well as brokers in LONDON. Become part of the SCHUMANN community and CONNECT. We look forward to seeing you!

Benefit from more than 25 Years of Experience

Future-proof Software

We set technological standards, continuously develop our products and invest in research and development on a regular basis.

Consultancy and Support

Our experts guide our customers through all phases of a project - from the initial idea to the successful implementation of our software. And even afterwards, we are always at our customers' side as a competent consultant.

Internationality

Most of our customers work worldwide, and many of them are based abroad. In addition to our company headquarters in Göttingen, we have offices in Leipzig and London.

Risks are always present in any business and can take various forms. In order to meet these challenges, effective risk management is of great importance. In this context it is essential to identify dangers and risks, to evaluate them, to control them and to take the necessary measures in order to avoid possible losses or at least to reduce them.

Companies are subject to various types of risk, which can be divided into several categories. SCHUMANN primarily has expertise in the area of financial risks (credit risks - default on payments, liquidity risks and compliance risks: failure to comply with laws and regulations). It is exactly in these fields that the use of risk management software is playing an ever more important role.

Risk management software serves to identify risks at an early stage and to record their details comprehensively. It offers an integrated platform on which risk analysis, risk evaluation and the management of measures can be performed efficiently and effectively. Such software is specialised in performing a range of functions:

Risk identification: Risk management software makes it possible to identify potential risks and to categorise them. This usually takes place with the inclusion of various departments and stakeholders within the company.

Risk evaluation: After the identification of risks, evaluation is performed. Here, the probability of the risk happening and its possible effects are analysed in order to prioritise the potential dangers.

Measure management: As soon as risks have been identified and evaluated, the software provides support with the planning and performance of measures to reduce the risks or avoid them completely. It enables the documentation and monitoring of these measures.

Control and monitoring: Risk management software makes it easier to control the identified risks. It enables constant monitoring in order to ensure that the measures taken are effective and helps you to modify them if necessary.

Reporting: The software usually provides comprehensive reporting functions, which enable risk information at various levels of the company to be presented transparently. This makes communication and decision-making easier.

Automated processes: Modern risk management software automates many processes, which not only saves time but also increases the accuracy and efficiency. This is especially important in large, complex organisations.

Risk management software solutions are used in various situations and business contexts. Here are a few examples:

Finance management: In the area of finance, risk management is of decisive importance. Software can provide support with the monitoring of credit risks and other financial challenges.

Compliance and governance: Companies need to comply with a wide range of regulations and standards. Risk management software can help to ensure that these requirements are fulfilled and the risks of non-compliance are minimised.

In summary, company-wide, automated risk management software is a valuable resource for the proactive identification, evaluation and control of risks. It helps to guarantee the resilience and the long-term sustainability of the company, and offers clear advantages in relation to efficiency, accuracy and effectiveness in dealing with risks.