Simple and fast modeling of data and decision models for risk management with the low-code tools in CAM.

As part of our SCHUMANN Conference Digital Credit Risk Management 2025, we offer you the opportunity to learn more about our products, special functionalities of our software and technologies. Selected partner companies will also be presenting themselves and their products.

Risk Management DIY

Flexible Portals - Seamless Integration

Integrate business partners seamlessly into your processes through self-service and the direct exchange of customized information

Innovation in TCI - Combine policies smartly

The extended TCI Manager links policies and other coverage options into chains. For a precise overview of your secured risks and more accurate balance reports.

Modern trade credit underwriting

Let the system help you focus on what really matters. Software can act like a safety net using guidance and effective information provision as a modern approach to trade credit underwriting.

Innovation meets user experience

Experience how modern design and flexible customization simplify your daily risk management tasks – intuitive, efficient, and user-centered.

As a product owner, the studied business administrator is responsible for the development of the standard software CAM Surety. With their work, she and her team, design the software to sustain the processes in your daily business and proactively involve you as a driving force – with focus on our product to enable success!

Product Owner Surety, SCHUMANN

Connect & Integrate - Think networked, act safely.

Connect & Integrate: Central connection of internal & external data sources (credit agencies, trade credit insurances). Automated data flows for well-founded credit/risk checks along your processes. Overview of integration, examples & added value

Rethinking processes with AI

Discuss with us the possibilities of using AI, potential use cases and possible workshops with our AI team

Tobias Nießner holds a PhD in Business Information Systems from the Georg-August University of Göttingen. He studied mathematics and business information systems with a focus on data science. During his PhD, he worked on risk use cases in accounts receivable management.

He joined SCHUMANN in 2023 as Product Owner to enable the product landscape with AI capabilities

Product Owner AI, SCHUMANN

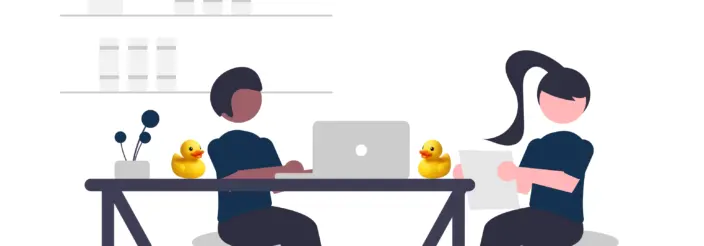

SCHUMANN trainees‘ project

SCHUMANN Desk Buddy

The SCHUMANN Desk Buddy displays the time, the weather, a little motivation or the latest SCHUMANN news. You select what you want to see in the web app and it is immediately displayed on your Desk Buddy. The duck shape of the Desk Buddy is inspired by the well-known ‘Rubber Duck’ in IT. The Rubber Duck is used to solve problems by explaining the current problem to it. Thinking out loud is often enough to find a solution straight away.

You can experience the Desk Buddy live at the SCHUMANN Conference as part of our Innovation Hub!

Auszubildende Financial Services, SCHUMANN