A common weakness in software projects is insufficient or even non-existent consideration of the underlying business processes. Even when these processes are in focus, they are often not analysed in detail in order to adapt them to new situations, or to restructure them as necessary. It does not usually make any sense to simply transfer an existing process into a new software solution without any reflection on how it works. A modern solution for receivables management must therefore be based on the specific requirements of the company.

Receivables Managers in Conflict of Interests?

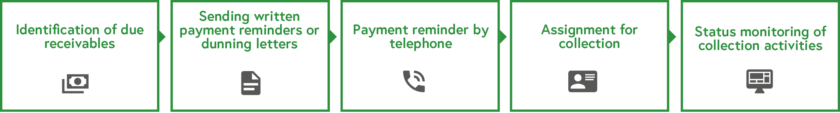

It is part of the daily activity of credit and receivables managers: overdue receivables must be identified and suitable measures initiated. The classical linear dunning procedure with its three or four dunning levels, follow-up telephone calls and legal action as the final stage does not, however, fulfil modern requirements for a customer-orientated way of dealing with late payers, and especially one which promises success.

Companies must be able to deal with their customers as individually as their customer relationships are diverse – also, and especially, when it comes to the collection of receivables. There is therefore an aspiration to be able to make decisions for individual cases and with great sensitivity as to which measure should be performed next and by whom in order to fulfil two aims equally: the receipt of payment and the retention or even the further extension of the business relationship with the customer.

Taking a look at what actually happens in companies shows that this aspiration and reality are often far apart. In many companies there is already IT system support for the area of receivables management, but flexibility and the possibilities to individualize often leave much to be desired. Therefore, the desire of receivables managers to be able to react quickly to changing conditions and to address the customer in a targeted manner with suitable methods can only be achieved to a limited extent. Furthermore, to realize this many manual steps in working processes currently dominate daily activities: additional information about the customer is first gathered (e.g. through internal discussions with the sales department or reporting via Excel) and then manual interventions are made in processes that are already (partially) automated. This means that the automation potential cannot be fully exploited. Another problem with intervening in defined processes is the documentation. Because of the lack of process conformity, it is often not clear which measures have been performed most recently. Separate notes are often kept about customers that cannot be evaluated electronically. Information of this type can therefore not be included in an evaluation of the customer, which hinders the following (automatable) processes and leads to mistakes (e.g. dunning pauses are not adhered to or unsuitable follow-up measures are performed).

One functionality that is currently also underrepresented is the generation of central and flexible evaluations. For example, many receivables managers do not have the possibility to directly evaluate the success of individual measures or to comprehend the current status of one or all of the measures. This information is therefore recorded in parallel (e.g. in Excel or in Access databases). Functional deficits in the area of reporting are typical reasons for the development of shadow IT.

In practice it is especially at the boundaries of the system that problems often occur. If a receivable cannot be collected, legal action follows, which in many companies means that the case is passed on to a debt collection agency or to a solicitor. Here, the receivables manager has to decide when to pass on the case and which information to send to the service provider. It is not unusual that the information is gathered together by hand and then sent by E-mail or uploaded or manually entered in a web portal. If information is missing, it has to be submitted later, errors occur during transmission and the current processing status is not always clear or possibly requires monitoring to be activated in the portal in use. This is only one example of how a lack of integration capability of an IT solution or an incomplete end-2-end process concept can lead to inefficiencies at the boundaries of systems in receivables management. In addition to looking at this from a purely functional point of view, it can be observed in practice that there are increasingly tighter commercial requirements on receivables management. There is significantly increasing time and cost pressure, which requires fast and efficient completion of pending tasks. More and more work has to be done by less and less personnel, quickly and without mistakes. Because of the weaknesses in the existing processes and IT solutions described above, however, this requirement can only be fulfilled with difficulty.

Many Receivables Managers Are Therefore Faced with the Challenge that They Should:

- deal with customers individually,

- strengthen customer loyalty,

- process a larger volume of cases,

- achieve a higher realization ratio and

- ideally use less time for all this!

Individually Tailored Receivables Management Requires Modern Software

The first consideration is that the software must provide support for monitoring payments received and payment deadlines. On the basis of flexibly defined criteria (e.g. allocation to customer groups, inland/foreign) suitable measures are then automatically suggested. In the example procedure described above, a written payment reminder is created and sent via an appropriate channel (e.g. E-mail or printed and posted). After a suitable, freely definable, dunning pause the system should suggest the next measure or even start it automatically. In the example process described, a payment reminder by telephone follows. In order to support this process, (1) the responsible employees need to be informed, (2) they must have the possibility to record the notes made during the telephone call and (3) a resubmission should also be possible (e.g. when the relevant speaking partner could not be contacted). At this level of detail there are diverse differences between the processes used by companies. Therefore, an IT solution needs to be as simple as possible to configure and adapt to the business process. This also applies to follow-up measures such as passing the case to a debt collection agency, as in the example above. At such a system boundary, suitable software ideally provides a predefined interface for transferring the case, so that the receivables manager is not burdened with manual transfer activities. After the transfer to the service provider the case still needs to be monitored, of course: in addition to the current status of individual receivables and the initiation of follow-up activities (e.g. the booking of payments received) this includes reporting at portfolio level to measure the success achieved.

The process described is only one possible method of procedure that can be used in receivables management. When, for example, a debt collection agency is not used, the procedures are completely different. The important factor is that the workflows behind the procedure can be set up by the company itself. The system must provide sufficient configuration possibilities so that when defined events occur it automatically provides receivables managers with the necessary information and makes recommendations for the initiation of suitable measures (e.g. a telephone call from the sales department). Despite this, in order to remain flexible manual intervention in automated workflows must be possible at any time. This means, for example, that when the receivables management system suggests sending a dunning letter the receivables manager should nevertheless have the possibility to initiate a telephone payment reminder as a follow-up measure. In addition, a modern IT solution must be able to document all of the steps taken, thereby making the procedure transparent and comprehensible for anyone.

Another key criterion when selecting a suitable IT solution is that its perspective is customer-centred. The customer should not notice that (part) automated processes are running in the background. The software of choice needs to put the company's own dunning policy into practice with the use of an intelligent architecture and flexible configuration possibilities. Through relief from routine activities together with diverse reporting functions such as the evaluation of the success of particular measures, the receivables manager is put in a position to concentrate on the optimization of the portfolio and the measures. As a result, the conflict of interests discussed in the first section can be resolved through the specific addressing of customers whilst at the same time dealing with a larger volume of cases and achieving higher rates of realization.

Workflow Automation with Dunning Groups

CAM Industry & Trade, the intelligent credit management software from SCHUMANN, responds to these challenges, offering a special module for dunning and debt collection as well as for the targeted realization of the necessary processes.

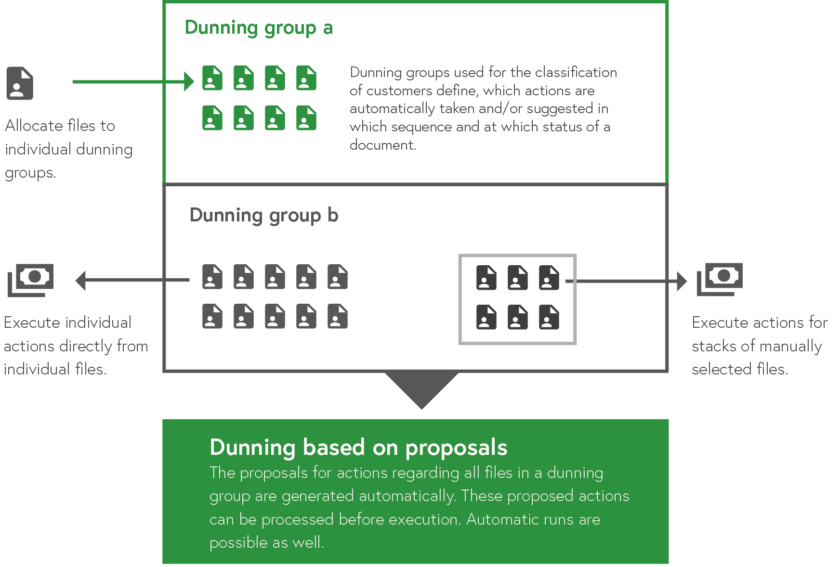

For this purpose, customers are grouped according to individually defined criteria. These customer groups or dunning groups can be allocated their own measures and sequences of measures – which can even be carried out fully automatically if desired.

A practical example: Important customers can be allocated to the group "VIP". For this group it is established that the customers in it will always be contacted initially by telephone, for example by the sales department. Optionally, individual telephone guidelines can be recorded, which the salesperson can use as orientation during the conversation.

Further measures that can be allocated include the manual or automatic sending of payment reminders in the company's corporate design and the automatic digital passing on of the receivable to an external service provider, who takes over the debt collections tasks. In the background, workflows specified by the company are used, which can be modelled in BPNM language graphically (even by the company itself). If a defined event occurs, the system informs the credit manager about it and suggests what to do next in relation to the customer. Measures that have already been performed are thereby taken into account. Suggestions made by the system can be carried out automatically – but do not have to be. There is the possibility, for example, to remove individual customers from a measure or to initiate measures other than those suggested. It is also possible, of course, to process individual customers independently of their dunning group and to take individual measures. These measures are also taken into account when suggesting further steps.

Advantages of Software Support in Receivables Management

- Reduction of operative costs

- Reduction of average collection periods

- Clear processes and responsibilities

- Increased customer retention

- Complete transparency

- Comprehensive analysis possibilities

The Next Level: A Fully Integrated Industry Solution

If receivables management is embedded into a complete software solution which also supports creditworthiness checks and credit limit allocation and presents everything transparently in credit files, conflicts of interest in receivables management become a thing of the past. Because of the modular design of CAM Industry & Trade, various expansion stages and individual configurations are possible.