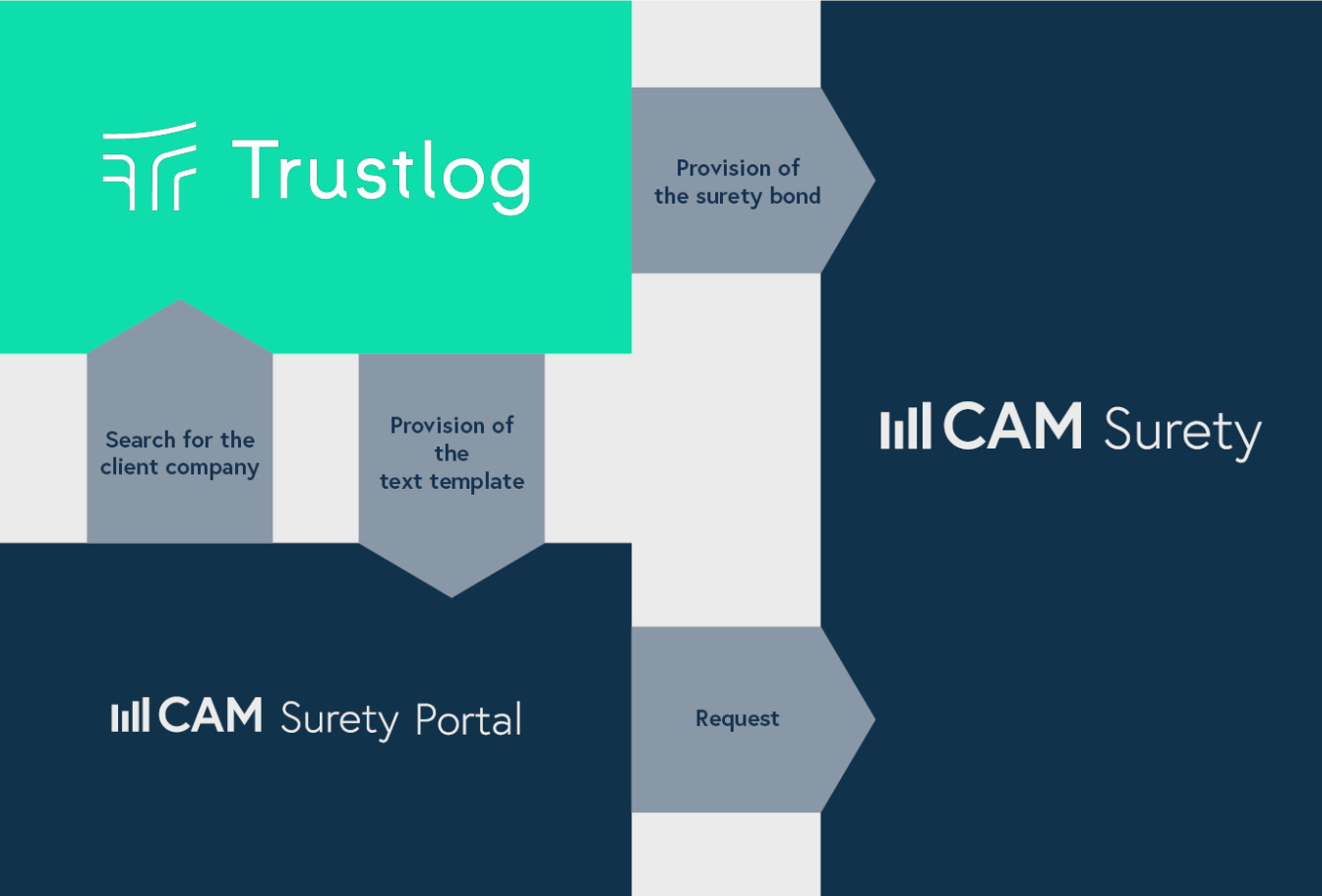

The texts are called up from Trustlog whenever a request is made via the Surety Portal. Miriam Löffler, Product Owner at SCHUMANN, explains: "As an insurance client I can log into the portal and request a surety bond directly. On the application form I can use search functions to identify the beneficiary via Trustlog. If the beneficiary already uses Trustlog, the portal can immediately access the bond texts that have been stored in Trustlog and kept up-to-date. It then goes very quickly: after a few entries regarding type of cover, amount and the acceptance of the general insurance conditions I can immediately take a look at a preview of the bond certificate."

After the form has been submitted, the request is passed to CAM Surety so that the underwriter can check it. Because the text has already being checked and agreed in advance by Trustlog, manual checking of the text is not necessary. This is the stage that offers the greatest potential for automation: If the surety bond is being called up from a facility agreement, the entire process of issuing the bond, from the request by the contractor in the portal to the issue in Trustlog, can be automated as there is no need for the guarantor to check the text manually.

Once the surety bond has been underwritten, the client company automatically receives an E-mail notification and can retrieve the issued bond from the Trustlog platform.

The acceptance of digital surety bonds is only possible with the participation of the client company. Many market participants are already trying to replace surety bonds on paper with PDF files, which is only a partial solution to the difficulties associated with the paper version. For example, all of the follow-up processes for the PDF variants continue to take place in paper form. "In the development of Trustlog we considered the process from the point of view of the client company consequently right from the start. The switch to digital surety bonds will only be possible if the client companies accept and actively demand them. More than 1500 such companies who use Trustlog every day show us that this is the right way to go," said Markus Scherer, Product Lead at Trustlog.

In contrast to the old "paper world", the beneficiary can either accept the surety bond with a click or, if corrections are necessary in specific cases, can reject the bond and enter the desired alterations. These desired alterations are then displayed directly to the underwriter as a task in the CAM Surety System. The underwriter then issues an update, which becomes available in Trustlog. "Customers have reported to us that the whole process with the paper surety bonds generally took a week from receiving the paperwork through checking it to registering it in their own system and now, thanks to the digital processes with Trustlog, the necessary time has been reduced to less than an hour", reported Scherer.